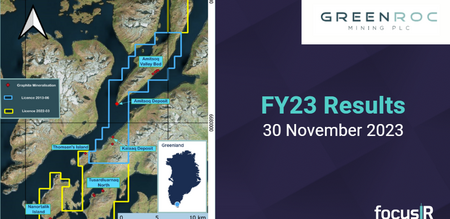

GreenRoc Mining (AIM:GROC) is focused on the development of critical mineral projects in Greenland, has announced the results of its Preliminary Feasibility Study (PFS) in respect of the establishment of a downstream processing plant to produce graphite active anode material from graphite concentrate mined from Amitsoq, South Greenland.

The PFS finds the downstream processing plant in Northern Europe to produce active anode graphite (Coated Spherical Purified Graphite) for EV lithium-ion batteries from Amitsoq’s graphite concentrate ‘economically robust’ with economic highlights including:

- Total gross revenue of US$6.5Bn over the 22-year period

- Total gross profit totalling US$2,785m

- Pre-Tax Net Present Value at 8% discount rate (NPV8) of US$837M

- After-tax NPV8 of US$545m with IRR of 25.3%.

- Initial capital cost (Capex) of US$321M inclusive of a 25% contingency.

- Average annual processing of 80,000t of graphite concentrate at 95% graphitic carbon (C(g)) with production of 39,700t of active anode material in the form of coated spherical purified graphite (CSPG).

In this interview, investors will also hear:

- Why the PFS indicates the processing plant will be highly profitable

- How the plant has achieved a 4-year payback period on capital from the start of production

- Why producing battery ready graphite from your own graphite concentrate has huge commercial advantages

- Why a green energy source is vital for the processing plant

- What sources of finance may be available

“The project numbers are really, really good. The total gross revenue over the 22-year period is over $6 billion dollars, which testifies to the economic robustness of doing downstream graphite processing. On a yearly basis, the 39,700 tonnes of processed active anode material is worth about $300M, sufficient to supply a million EV cars with batteries, equivalent to the entire UK production of cars if they were all electric,” explained Stefan Bernstein, CEO at GreenRoc Mining.

Reasons to add GreenRoc Mining to your Watchlist:

- World class graphite deposit at Amitsoq in Southern Greenland

- High-margin processing plant benefits from high-quality, stable source of feedstock

- Preliminary Feasibility Study illustrates exceptional processing plant economics

- Positive PEA economics for Amitsoq

- Pre-Feasibility Study for Amitsoq due 2024

- One of only a handful of European vertically integrated graphite miners also intending to process anode graphite for EV’s

Stefan Bernstein, CEO of GreenRoc Mining, was interviewed by Donald Leggatt at focusIR.